It’s common knowledge in the tax and business world that health insurance premiums paid for S corporation shareholders are often deductible on the officer’s personal tax return, depending on the facts and circumstances of individual officers.

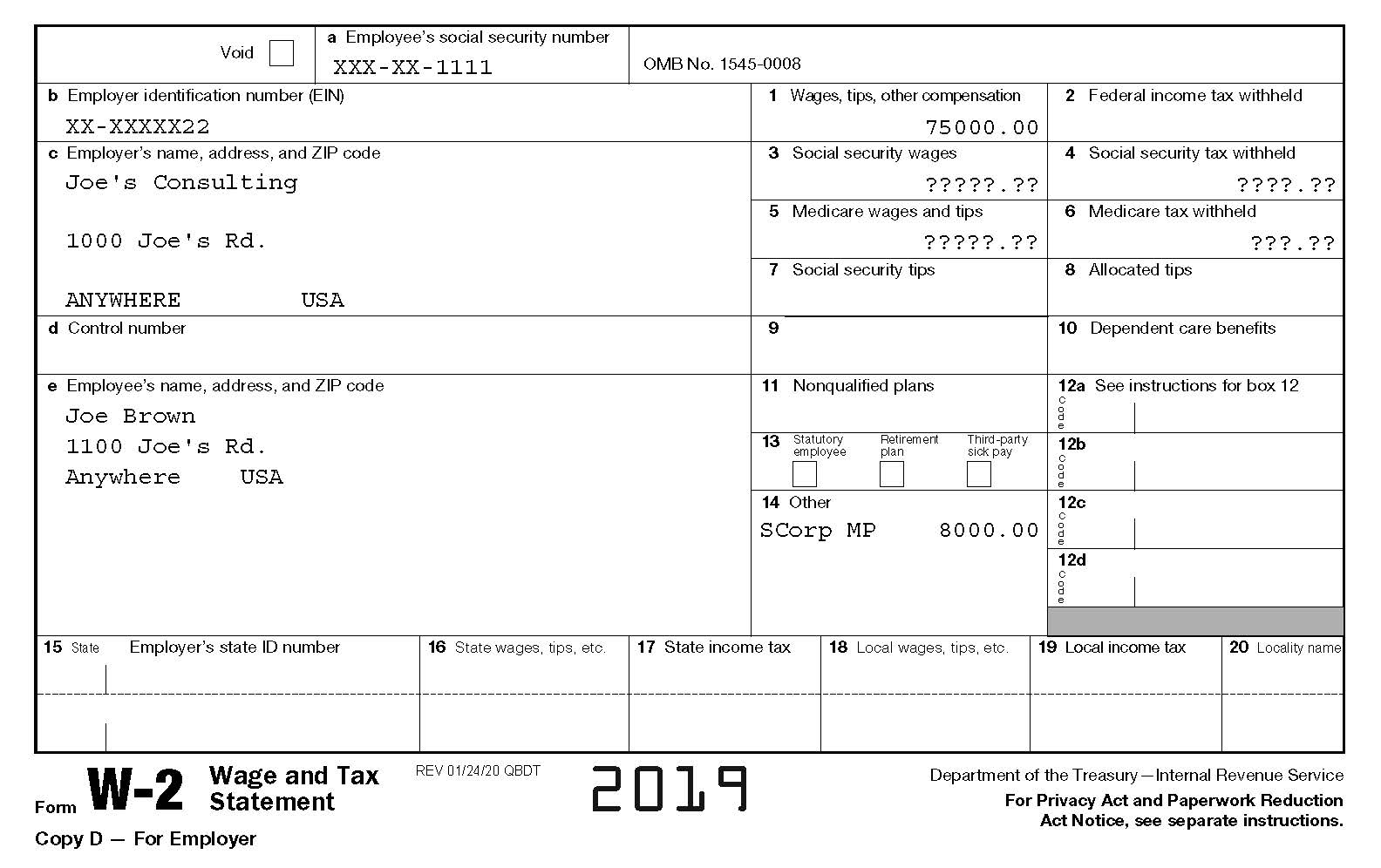

The premiums are included in the officer’s salary and reported in Box 1 of the officer’s W-2. The premiums are also reported in Box 14. When the premiums are reported correctly, and the officer qualifies to deduct them, the Box 14 premiums may be deducted on the way to arriving at adjusted gross income, what many refer to as an above-the-line deduction.

A far-less understood aspect of that deduction is the taxability of those premiums with respect to payroll taxes.

The Affordable Care Act, which resulted in anything but affordability in healthcare, cast doubt and confusion on the future treatment of S corporation officer health premiums. It appeared that no deduction would be allowed for officers of corporations that failed to provide full-time employees with proportionate health premiums, or in other words, corporations that discriminate with regard to health insurance. For example, if a company paid 50 percent of health premiums for officers and employees, no problem, but the Affordable Care Act suggested that shareholders of those companies covering officer-employees, but not rank-in-file employees, would not be able to deduct their premiums.

Then, Notice 2015-17 was issued, essentially stating the S corporations could carry on as they were, based on guidance given several years earlier in Notice 2008-1, until further guidance was issued. In other words, S corporations could still discriminate.

The lesser-known side of the S corporation shareholder health premium treatment is how health premiums are treated for payroll tax purposes when corporations discriminate, and it has not changed since before the Affordable Care Act, but has often been ignored.

When a corporation does not discriminate, the premium amount, as previously mentioned, is reported in Box 1 of the W-2, but not Boxes 3 and 5, exempting the premiums from Social Security and Medicare taxes. It’s quite a nice deal.

When a corporation does discriminate, the premiums are reported in Boxes 3 and 5, as well as in Box 1. This can be significant. It means that an officer for whom a discriminating company paid 10,000 dollars in health premiums will be out 765 dollars more than the officer of a company that did not discriminate. Furthermore, the company will be out an additional 765 dollars for the employer portion of Social Security and Medicare taxes. The combined bump-up in taxes between the employee and the S corporation come to 1,530 dollars, and that’s just for one employee.

While the self-employed health insurance deduction can provide a nice tax break to both employer and employee, S corporations should be fully aware of the ramifications of officer versus employee treatment when it comes to health insurance.

Fill out Form below to email Gary for a free consultation.

Website Design by studio1c